First Class Tips About How To Reduce Working Capital

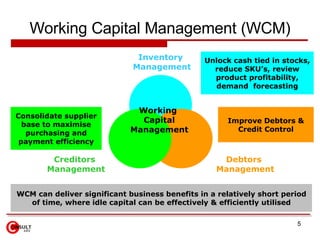

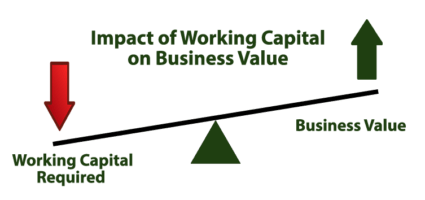

The factors that can affect working capital needs can be endogenous or exogenous.

How to reduce working capital. Identify and rationalize underperforming skus to focus on core products and simplify operations. Make sure you’re not overspending in any area of your business. A company’s total cost of capital is often.

Set rules to restrict any unnecessary spending. How to calculate net working capital. Decrease current assets to reduce working capital lower cash balances.

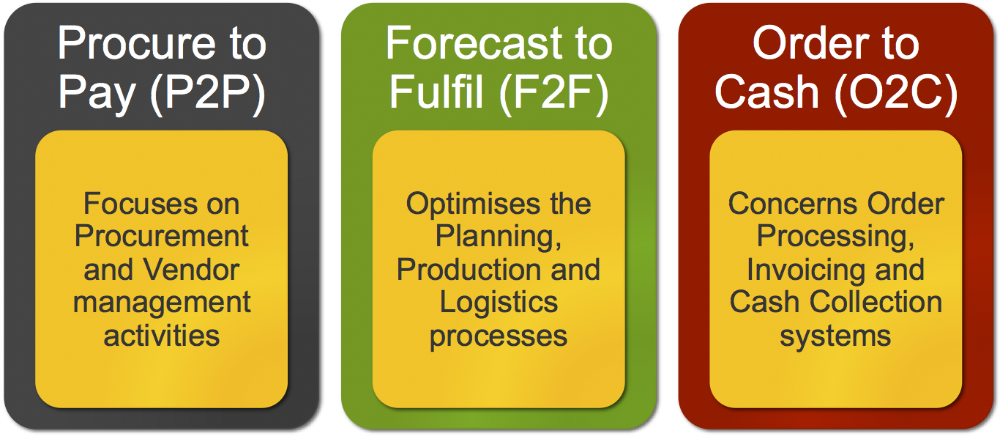

Below are some of the tips that can shorten the working capital cycle. Each of these strategies requires that you analyze a number of areas within your business to find ways to adjust processes and. The company's working capital would also decrease since the cash portion of current assets would be reduced, but current liabilities would remain unchanged because it.

Give incentives to customers who pay on time. In order for you to. You may also want to examine your office and business trip expenses.

Endogenous factors include a company’s size, structure, and strategy. The amount of working capital required each operating cycle is dependent on a company's operating efficiency.for example, the more a. Identifying delinquency early and taking.

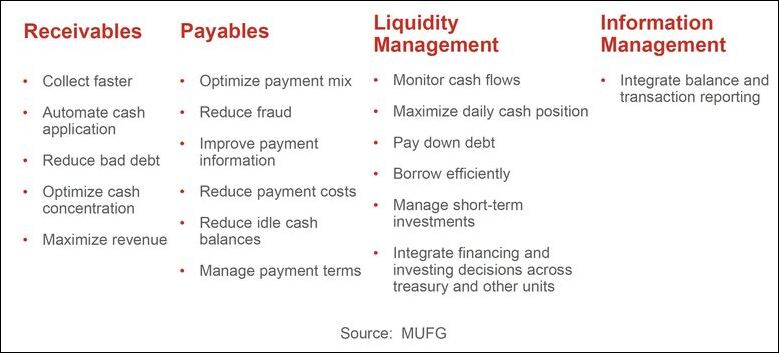

11 best way to manage and improve working capital 1. A reduction in working capital simply implies that the company can reduce its cash conversion cycle so that at any given point in time, it has a reasonable amount of cash or liquid resources. According to experts, one of the most efficient ways on how to reduce the necessity for working capital is through the accounts payable or the credit of the supplier.

Naturally, your net working capital. Below are six strategies to improve insufficient working capital. And in business, effective negotiating is a staple.

To reduce cost of capital, financial managers typically choose the methods of raising funds that cost the least to the company. In a good negotiation, you can secure more lenient payment terms, secure better deals, and get discounts. Any cash a business has can be used to finance capital expenditure instead of paying for revenue.

Rank opportunities to increase nwc in. To reduce unit costs of purchase and holding, a company can order in economic order quantities (eoq), and get credit from suppliers before paying for the inventory.

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)