Looking Good Tips About How To Reduce Your Federal Taxes

The more deductions you have, the.

How to reduce your federal taxes. 12 ways to lower your taxable income this year 1. You can contribute up to $2,750 in 2020 and. Enter your information in the calculator and determine your federal tax.

1 day agoalbany, ga (31701) today. Contributions to a 401k retirement account or individual retirement account (ira) can help lower your taxes by reducing taxable income. Stash money in your 401 (k) less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills.

Add money to your fsa money that is free of tax can be funded into your fsa annually, which lets you lower your tax bill too. Read pros & cons today! Out of sight, out of mind.

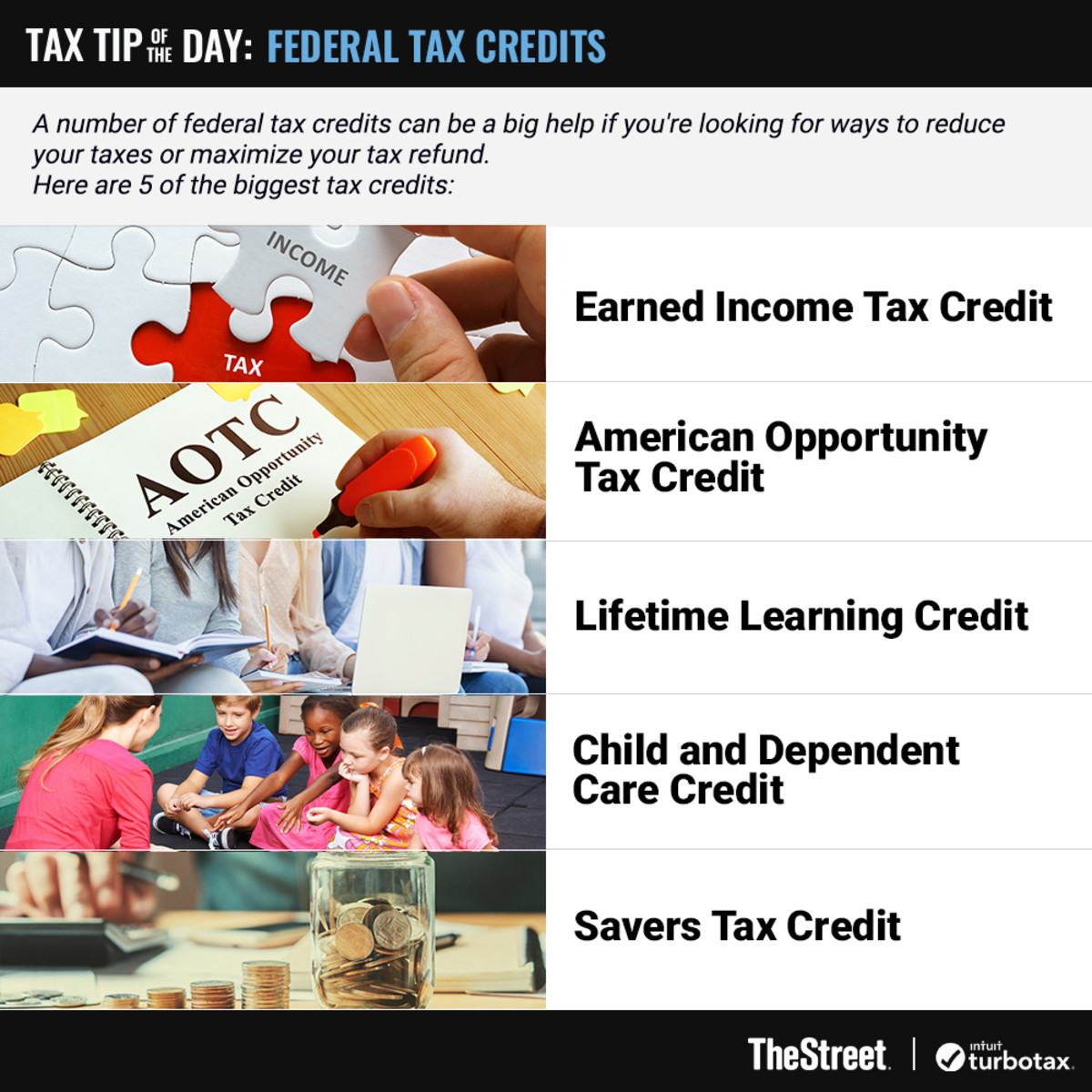

How credits and deductions work. The key to minimizing your tax liability is reducing the amount of your gross income that is subject to taxes. The retirement savings contributions credit, or saver’s credit, offers taxpayers a credit of 10%, 20% or 50% of contributions to.

How to reduce tax withholding visit the irs website at irs.gov and navigate to the withholdings calculator. Winds wnw at 10 to 15 mph. Retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost everyone.

While everyone’s tax situation is different, there are certain steps most taxpayers can take to lower their taxable income. Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to. Interest income from municipal bonds is generally not subject to federal tax.

Capital loss deductions can reduce taxes further. Here are 5 ways to reduce your taxable income 1. One way to do that is not to have the money in your possession at all.

Consider increasing your retirement contributions. Ad we have picked the top(5) back tax help companies out of 100's. Get facts, & breakdowns of back tax help companies.

Compare & find best value for you. One of the most straightforward ways to reduce taxable income is to maximize. Take advantage of these strategies to save on your income taxes.

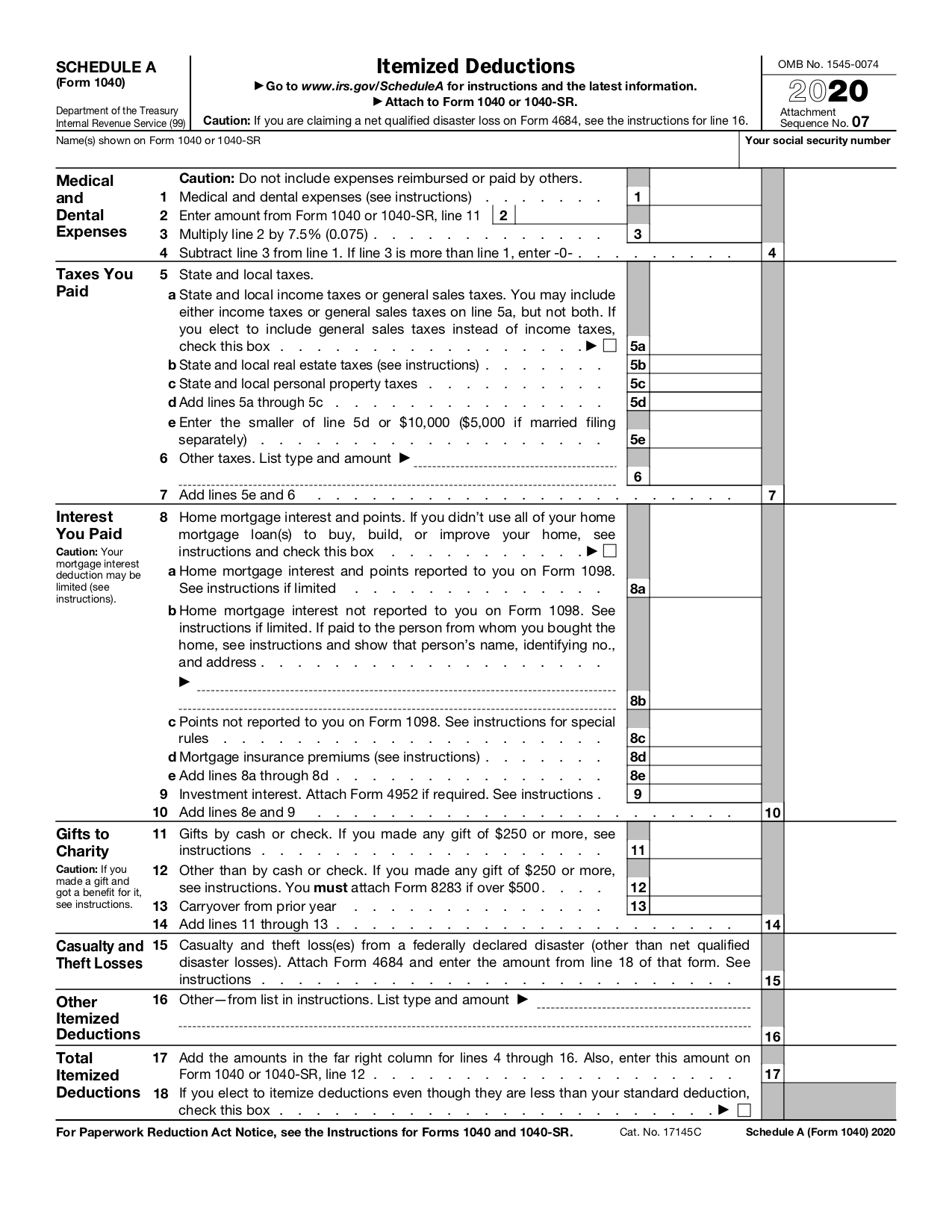

Charitable and other gifts lowest tax rate on first $200. This credit will reduce his tax bill to zero. When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)