Cool Tips About How To Check Bad Credit

You might find that you signed up.

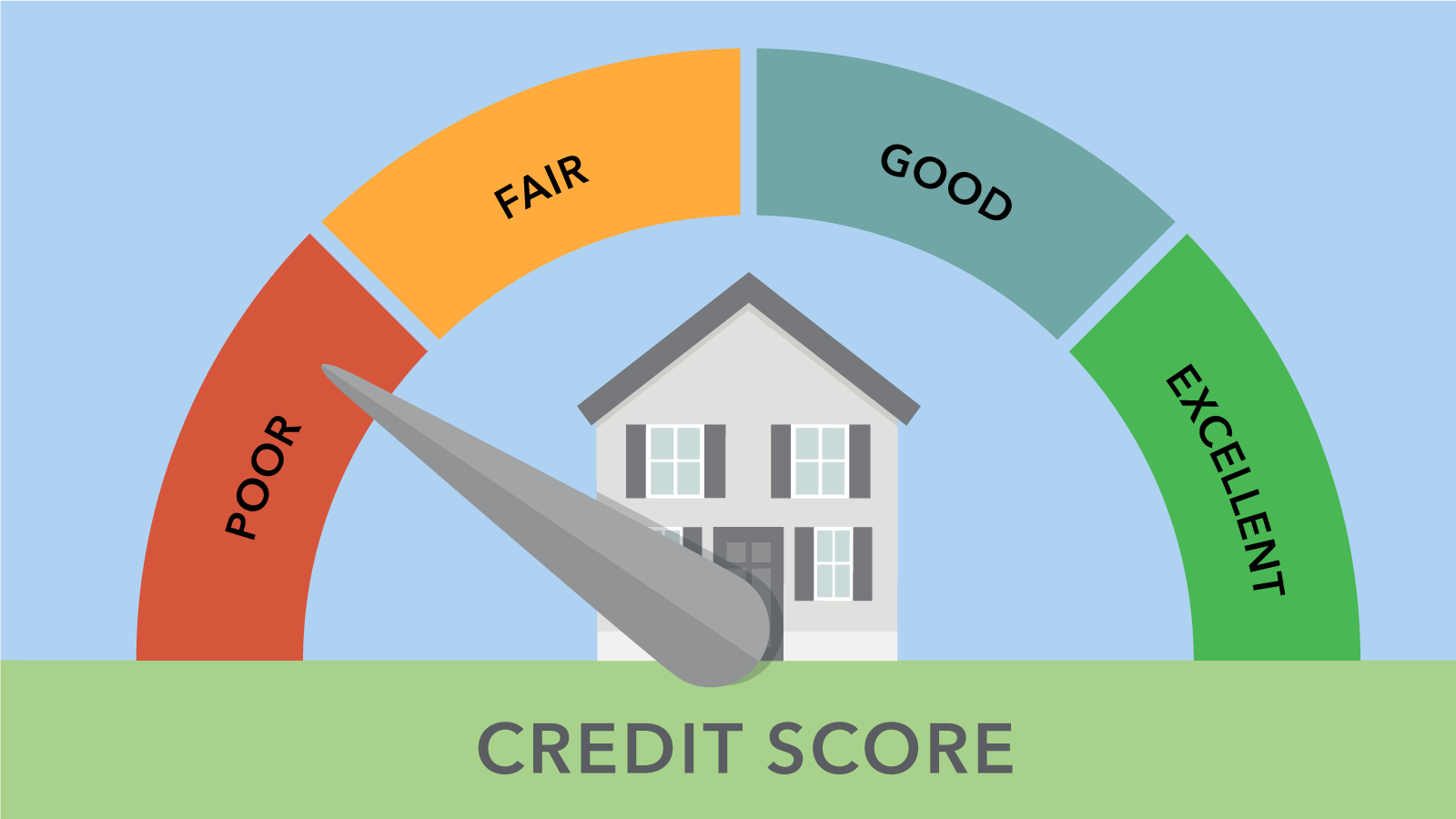

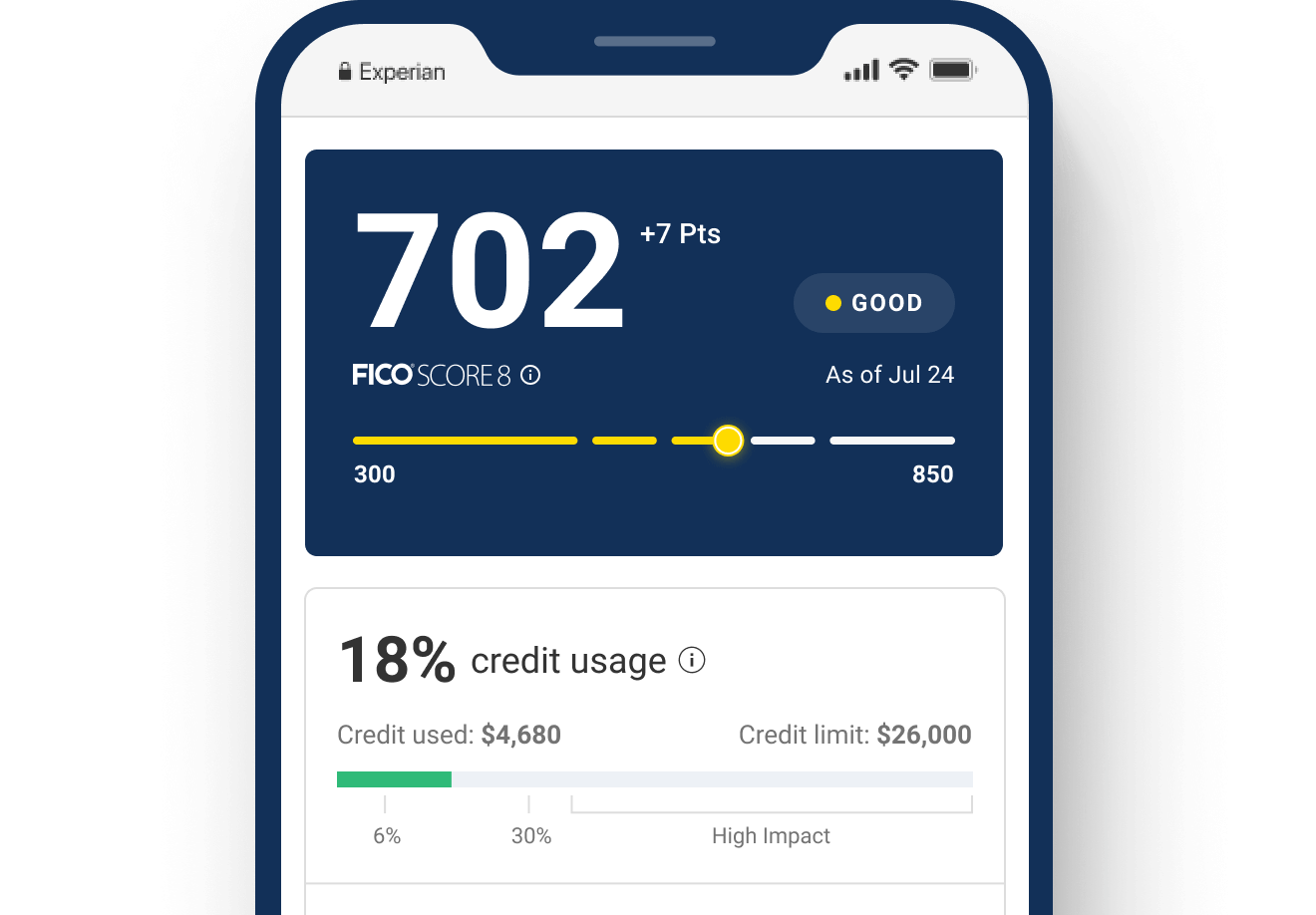

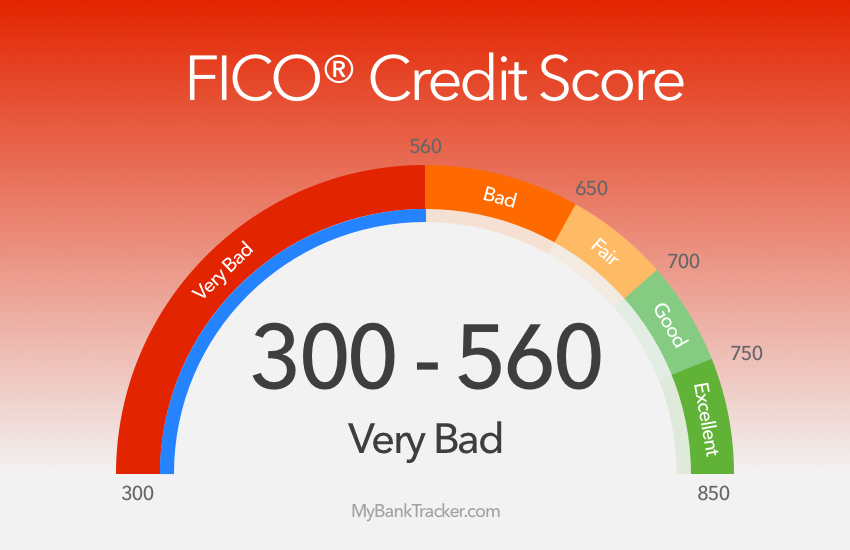

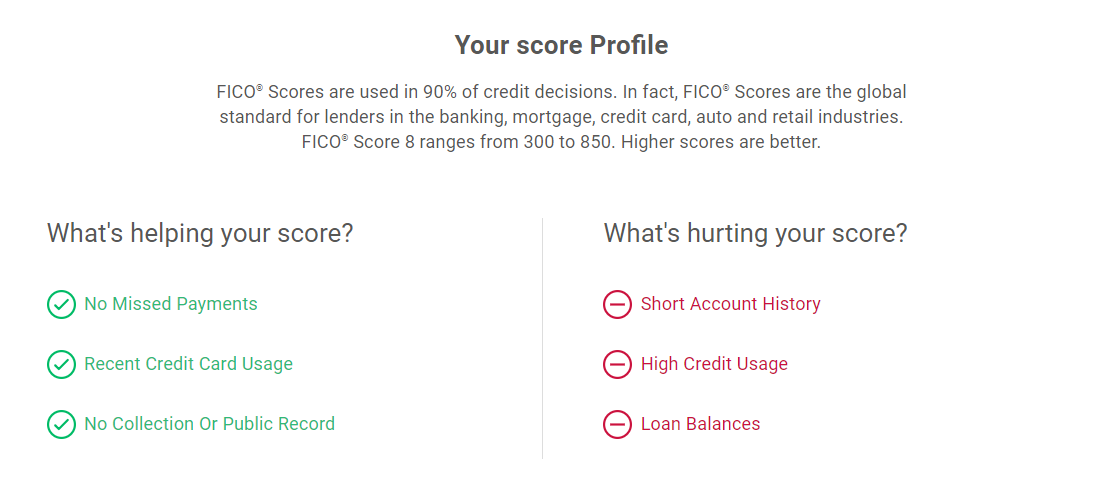

How to check bad credit. A bad credit score is classified as below 579 on the fico score model and below 600 on the vantagescore. Check your credit card, financial institution or loan statement. The name of the site reveals how welcoming it is towards borrowers with bad credit.

A cosigner, sometimes called a guarantor, is a person with great credit and income who can. A check of your credit score is secure because it won’t hurt your score, but all inquiries are alike. Financial institutions use credit scores to measure your credit risk.

Request your free credit report: Start by reviewing your credit report thoroughly. This is where you can expect approval for a.

To submit a dispute online. 1 day agobut first, take a look at the best 5 out of our list to get an idea about the top companies for bad credit loans. Many credit card companies, banks and loan companies have started providing credit scores for their.

Because no credit check loans guaranteed approval with interest ranging from 5.99% to 35.99% can be secured via the viva payday loans platform despite low credit, it is very. Look for any information that's incorrect, such as paid. Check and correct your credit report.

The fact that you can check your credit score doesn’t harm your score is a. Different companies have different scores. Low scores are around 300.

The easiest way to rent with bad credit is by leasing with the help of a cosigner. How to get rid of bad credit. How to check your credit reports on annualcreditreport.com step 1:

The platform features competitive terms that. Check your credit score and reports. Soft inquiries have no influence on your credit scores.

It may be possible to check your credit score through your bank, or by going directly to one of the credit reference agencies, such as equifax or experian. Here are a few ways: This type of emergency payday loan rarely.

Here are five steps to follow. A low credit score means you have bad credit. Maybe you know there are negative marks on your credit, but you haven’t requested a report recently.